VANCOUVER, BC - For the 20th year, REALTORS® across the Lower Mainland gathered warm clothing and blankets to help over 17,000 working poor and homeless people in our region and what stood out most during this year’s Blanket Drive – November 17 to 24 – was the quality and specificity of donations.

Sue Mukerji, Surrey REALTOR® and Blanket Drive volunteer for over ten years, observes, “The message that it’s not about quantity is really getting through now. Our goal has always been to collect the highest quality items to meet the needs of our most vulnerable citizens in each of our communities.

“Some of our charities request only blankets; others indicate they need mainly socks or underwear. Surrey’s Hyland House specifically asked for new pillows. Because we have REALTORS®, clients and members of the public who have been supporting us for many years, we have a network to help fulfill the unique requests as best we can.”

One group that regularly receives donations from the Blanket Drive is the Hope Central Ministry at New Heights Church in Mission. They provide food and other services to both low income families and to individuals living outdoors. Carrie Prentice is the ministry coordinator and the church’s only staff person. “For many of our clients, their only source of warmth is a blanket and winter clothing provided by the Blanket Drive.

“We were very touched when two REALTORS® returned after dropping off donations to bring us literally bags of socks. Something as simple as a clean, new pair of socks can really make a big difference to someone’s quality of life.”

Harvest Project Development officer Kevin J. Lee, said, “Thank you REALTORS Care® Blanket Drive! The donated items allow us to provide coats and clothing to women and men returning to the work force or school and help those simply in need of proper clothing for the winter season.”

Established in 1994, the Blanket Drive is the largest, most recognized warm clothing and blanket collection in the Lower Mainland and has assisted more than 250,000 people. Donations from REALTORS®, their clients, the general public, corporations, retailers, community groups and schools are dropped off at over 100 real estate offices from Whistler to Hope.

The REALTORS Care® Blanket Drive is a partnership between the REALTORS® of the Real Estate Board of Greater Vancouver, the Fraser Valley Real Estate Board and the Chilliwack and District Real Estate Board and their communities.

by FVREB

Friday, December 19, 2014

Tuesday, December 16, 2014

The 2014 edition of CMHC's Rental Market Report - Vancouver-Abbotsford

Click here to download the report ---->

Wednesday, December 10, 2014

Thursday, December 4, 2014

Barbara Yaffe: Vancouver’s real estate forecast to stay hot into next year, study finds

Foreign money and a robust provincial economy will preclude any cooling of Vancouver’s red-hot property market next year, according to a major real estate study being released Wednesday.

Office space is the one real-estate category where an oversupply is forecast in the city, to be accompanied by potential downward pressure on pricing.

That assessment comes courtesy of a voluminous annual report, titled Emerging Real Estate Trends 2015, issued jointly by the Urban Land Institute and PricewaterhouseCoopers.

It describes Vancouver’s market as one of the country’s “best bets” in 2015, fourth strongest in the country in terms of investment, development and housing.

Vancouver trails Calgary and Edmonton, boosted by Alberta’s resource industry, and Toronto, where a still-strong condo market is being bolstered by people flocking to live downtown, in more compact spaces.

The report’s bullishness on Vancouver is tied to a recent Conference Board of Canada prediction that, during the next three years, the West Coast city will lead all other major urban centres in economic growth — with a 3.2-per-cent annual increase in output.

The report also cites the role being played by Greater Vancouver’s relatively new tech industry.

And, of course, Vancouver is “a hedge city.”

It “lacks the cachet of Paris or Milan,” opines the report. “But it does offer ... a place for the world’s super-rich to park sizable funds in local real estate as a hedge against risk.

“Returns aren’t the point; safety of capital is, and a $5-million condo is more insurance policy than investment.”

The report also notes that foreign buyers, mainly from Hong Kong and China, account for the purchase of about 40 per cent of the luxury homes and are “one of the key reasons Vancouver real estate prices continue to rise.”

With the economy on a roll and so many foreign buyers, the city has issued a record number of building permits in 2014.

The report identifies a concern about a possible office-space glut resulting from several new office towers being completed.

“Some foresee AAA space leasing at B rates.”

No such discount rates are anticipated in the residential sector. The report features a chart showing Vancouverites in 2015 will spend more than 50 per cent of household income on shelter — significantly more than in other cities, even Toronto where just more than 30 per cent will go to housing next year.

Overall in Canada, the property market is expected to be steady, with urbanization being the “new normal. People are flooding into city cores to live close to both work and the lifestyle they crave.”

Retailers and companies are following them with some builders incorporating stores and offices into their centrally located residential housing developments.

Western Canada’s real-estate market will continue to be the most robust, with the region acting as “the country’s economic engine.”

In a separate analysis on Wednesday that focused exclusively on the Vancouver market, Urban Analytics Managing principal Mike Ferreira told a downtown luncheon audience of realtors and developers that not since 2014 have sales for multi-family housing been so strong.

The real estate strategist said investors comprise a significant portion of condo buyers in Vancouver and Burnaby, but purchasing also has been strong among first-time buyers “with help from mom and dad, and low interest rates” and mature buyers, downsizing from single-family homes.

Ferreira told his audience the Chinese are a strong component of the market “and I suspect we will see more impact from that buyer group as we go along, especially with (the political instability) we are seeing in Hong Kong.”

Office space is the one real-estate category where an oversupply is forecast in the city, to be accompanied by potential downward pressure on pricing.

That assessment comes courtesy of a voluminous annual report, titled Emerging Real Estate Trends 2015, issued jointly by the Urban Land Institute and PricewaterhouseCoopers.

It describes Vancouver’s market as one of the country’s “best bets” in 2015, fourth strongest in the country in terms of investment, development and housing.

Vancouver trails Calgary and Edmonton, boosted by Alberta’s resource industry, and Toronto, where a still-strong condo market is being bolstered by people flocking to live downtown, in more compact spaces.

The report’s bullishness on Vancouver is tied to a recent Conference Board of Canada prediction that, during the next three years, the West Coast city will lead all other major urban centres in economic growth — with a 3.2-per-cent annual increase in output.

The report also cites the role being played by Greater Vancouver’s relatively new tech industry.

And, of course, Vancouver is “a hedge city.”

It “lacks the cachet of Paris or Milan,” opines the report. “But it does offer ... a place for the world’s super-rich to park sizable funds in local real estate as a hedge against risk.

“Returns aren’t the point; safety of capital is, and a $5-million condo is more insurance policy than investment.”

The report also notes that foreign buyers, mainly from Hong Kong and China, account for the purchase of about 40 per cent of the luxury homes and are “one of the key reasons Vancouver real estate prices continue to rise.”

With the economy on a roll and so many foreign buyers, the city has issued a record number of building permits in 2014.

The report identifies a concern about a possible office-space glut resulting from several new office towers being completed.

“Some foresee AAA space leasing at B rates.”

No such discount rates are anticipated in the residential sector. The report features a chart showing Vancouverites in 2015 will spend more than 50 per cent of household income on shelter — significantly more than in other cities, even Toronto where just more than 30 per cent will go to housing next year.

Overall in Canada, the property market is expected to be steady, with urbanization being the “new normal. People are flooding into city cores to live close to both work and the lifestyle they crave.”

Retailers and companies are following them with some builders incorporating stores and offices into their centrally located residential housing developments.

Western Canada’s real-estate market will continue to be the most robust, with the region acting as “the country’s economic engine.”

In a separate analysis on Wednesday that focused exclusively on the Vancouver market, Urban Analytics Managing principal Mike Ferreira told a downtown luncheon audience of realtors and developers that not since 2014 have sales for multi-family housing been so strong.

The real estate strategist said investors comprise a significant portion of condo buyers in Vancouver and Burnaby, but purchasing also has been strong among first-time buyers “with help from mom and dad, and low interest rates” and mature buyers, downsizing from single-family homes.

Ferreira told his audience the Chinese are a strong component of the market “and I suspect we will see more impact from that buyer group as we go along, especially with (the political instability) we are seeing in Hong Kong.”

2014 trend towards increased sales and steady pricing continues into November

SURREY, BC – The Fraser Valley Real Estate Board processed 1,136 sales on its Multiple Listing Service (MLS®) in November, an increase of 15 per cent compared to the 986 sales during the same month last year and 22 per cent lower than the 1,448 sales processed in October.

New listings in the Fraser Valley decreased by 2 per cent in November, going from 1,774 last year to 1,748 last month taking the number of active listings to 8,302, a decrease of 4 per cent compared to the 8,641 active listings in November of 2013.

“This is the time of year when families are settling in for winter and the holidays, so we expect to see a decrease in activity,” explains the Board’s president, REALTOR® Ray Werger. “After a busy fall with volumes reaching 5-year highs, we’re winding down the year with sales on par with the ten-year average, but about 8 per cent fewer new listings therefore home buyers will notice a shortage of inventory in certain price ranges.”

Pricing continues along the same trends as seen for most of 2014, with single family detached prices continuing to rise; townhouse prices remaining steady, and apartment prices decreasing. The MLS® Home Price Index (MLS® HPI) benchmark price of a detached home in November was $575,400 an increase of 4.6 per cent compared to November 2013, when it was $550,300.

The MLS® HPI benchmark price of townhouses increased 2.2 per cent from $292,400 in November 2013 to $298,900 last month. The benchmark price of apartments decreased year-over-year by 3.5 per cent, going from $196,200 in November of last year to $189,400 in November 2014.

“Prices are a function of supply and demand - which your REALTOR® will explain varies considerably from area to area and within the different property types - as well as local amenities, transportation options and future community development, underscoring the importance of expert guidance when you’re looking to list or buy,” says Werger.

“Overall, 2014 is shaping up to be a good year for Fraser Valley real estate,” continues Werger. “We hit a bit of a trough during the summer of last year, but since then sales have recovered and we’re tracking towards a 15 per cent increase in year-to-date sales for 2014 compared to 2013 with prices remaining relatively stable.”

New listings in the Fraser Valley decreased by 2 per cent in November, going from 1,774 last year to 1,748 last month taking the number of active listings to 8,302, a decrease of 4 per cent compared to the 8,641 active listings in November of 2013.

“This is the time of year when families are settling in for winter and the holidays, so we expect to see a decrease in activity,” explains the Board’s president, REALTOR® Ray Werger. “After a busy fall with volumes reaching 5-year highs, we’re winding down the year with sales on par with the ten-year average, but about 8 per cent fewer new listings therefore home buyers will notice a shortage of inventory in certain price ranges.”

Pricing continues along the same trends as seen for most of 2014, with single family detached prices continuing to rise; townhouse prices remaining steady, and apartment prices decreasing. The MLS® Home Price Index (MLS® HPI) benchmark price of a detached home in November was $575,400 an increase of 4.6 per cent compared to November 2013, when it was $550,300.

The MLS® HPI benchmark price of townhouses increased 2.2 per cent from $292,400 in November 2013 to $298,900 last month. The benchmark price of apartments decreased year-over-year by 3.5 per cent, going from $196,200 in November of last year to $189,400 in November 2014.

“Prices are a function of supply and demand - which your REALTOR® will explain varies considerably from area to area and within the different property types - as well as local amenities, transportation options and future community development, underscoring the importance of expert guidance when you’re looking to list or buy,” says Werger.

“Overall, 2014 is shaping up to be a good year for Fraser Valley real estate,” continues Werger. “We hit a bit of a trough during the summer of last year, but since then sales have recovered and we’re tracking towards a 15 per cent increase in year-to-date sales for 2014 compared to 2013 with prices remaining relatively stable.”

Monday, November 17, 2014

Canada's average house price rises to $419,699

OTTAWA -- Canadian home sales in October were up seven per cent compared with a year ago, driven by the markets in Vancouver, Calgary and Toronto.

Canadian Real Estate Association said Monday the increase came as sales last month climbed 0.7 per cent nationally compared with September, when sales dipped.

"Low interest rates continued to support sales in some of Canada's more active and expensive urban housing markets and factored into the monthly increase for national sales," CREA president Beth Crosbie said in a statement.

The average price of a home sold through the Multiple Listing Service was $419,699 in October, up 7.1 per cent from $391,931 in October 2013. The aggregate composite MLS home price index was up 5.51 per cent compared with a year ago.

CREA noted sales in Vancouver, the Fraser Valley, Victoria, Calgary and Toronto combined to account for almost 40 per cent of the sales nationally and nearly 60 per cent of the year-over-year increase.

Bank of Montreal senior economist Robert Kavcic cautioned that the national totals masked "widely divergent regional trends."

"In fact, any talk of housing market strength really comes down to a discussion about Vancouver, Calgary and Toronto," Kavcic noted.

"It's still a three-city show in Canada's housing market. While price momentum in Calgary might finally be slowing, Vancouver and Toronto continue to strengthen."

The number of newly listed homes rose 0.8 per cent in October compared to September while the sales-to-new listings ratio was 55.7 per cent in October, suggesting a balanced housing market.

CREA noted that just over half of all local markets were within the 40 to 60 per cent range it suggests represents a balanced market.

Information provided by CTV NEWS

Friday, November 14, 2014

RBC Financial Planning Tips, Facts and B.C. Media Contacts for National Financial Planning Week

WHICH… are the 5 financial concerns that are top of mind in B.C.?

- Should I pay down my mortgage or invest in my RRSP?

- I can't afford to save in both an RRSP and a TFSA – how do I know which one is right for me?

- When can I afford to retire?

- I have a Will, why do I need an estate plan?

- How can I help ensure my elderly parents are well cared for, financially and emotionally?

WHAT… are the 5 top tips RBC Financial Planning has for people in B.C. to help them manage their finances?

- Pay yourself first – this continues to be a simple but very effective approach to saving.

- Have a financial plan that you can share with your family and Financial Planner to help determine the best way to reach your goals.

- Review your financial goals on a regular basis and revise them as your life changes (marriage, children, yearly income, retirement).

- Reduce your most expensive debts as much and as quickly as you can.

- Learn about tax-saving options – RRSPs, TFSAs, RESPs, RDSPs – and make regular contributions to the tax-savings options that are best for you.

HOW… many people in B.C. have RRSPs and TFSAs?

- 60 per cent have RRSPs (compared to 59 per cent nationally)

- 53 per cent have TFSAs (compared to 54 per cent nationally)

WHO… can B.C. media talk to about financial planning advice?

- Jayelene Catala, Financial Planner, Vancouver,

B.C.

RBC Financial Planning

WHERE…can B.C. media find more information?

- Please contact Ian Colvin,

Senior Manager, Communications, RBC

ian.colvin@rbc.com or 604-665-4031

SOURCE RBC

Information provided by CNW Group

Thursday, November 6, 2014

Navigating with a REALTOR® - Your REALTOR® can help you:

- Navigate the home buying process and paperwork from start to finish, ensuring everything flows smoothly without any surprises.

- Find the right home, in the neighbourhood you want, at a price you can afford.

- Compare your property with similar properties that have sold over the past year.

- Get a feel for the neighbourhood including schools, parks and other amenities.

- Find out if you are eligible for government homeownership incentive programs.

- Assess mortgage products and different types of lenders to see what fits your needs.

- Negotiate purchase price and contract terms, such as date of possession, required repairs, included furnishings or equipment.

- Direct you through complex contracts.

- Find qualified industry professionals, such as real estate lawyers, home appraisers and home inspectors.

- Plan for closing costs and other related expenses

Information supplied by the Canadian Real Estate Association

Tuesday, October 28, 2014

Friday, October 10, 2014

Canadian Employment Figures - October 10, 2014

BCREA ECONOMICS NOW

Canadian Employment - October 10, 2014

The Canadian labour market broke out of its summer slumber, adding 74,000 jobs in September, nearly all of which were in full-time employment. Total hours worked, which is closely associated with economic growth, rose 0.3 per cent and the national unemployment rate fell 0.2 points to a 6 year low of 6.8 per cent.

The BC economy saw employment grow by 9,600 jobs in September. Moreover, recent losses in full-time work were overturned as full-time employment grew by 20,600 while part-time employment declined by 11,000. The provincial unemployment rate remained unchanged at 6.1 per cent. Year-to-date, employment in BC is up just 0.6 per cent.

For more information, please contact:

Cameron Muir

Chief Economist

Direct: 604.742.2780

Mobile: 778.229.1884

Email: cmuir@bcrea.bc.ca

Brendon Ogmundson

Economist

Direct: 604.742.2796

Mobile: 604.505.6793

Email: bogmundson@bcrea.bc.ca

The British Columbia Real Estate Association (BCREA) is the professional association for more than 18,500 REALTORS® in BC, focusing on provincial issues that impact real estate. Working with the province’s 11 real estate boards, BCREA provides continuing professional education, advocacy, economic research and standard forms to help REALTORS® provide value for their clients.

Real estate boards, real estate associations and REALTORS® may reprint this content, provided that credit is given to BCREA by including the following statement: “Copyright British Columbia Real Estate Association. Reprinted with permission.” BCREA makes no guarantees as to the accuracy or completeness of this information.

Canadian Employment - October 10, 2014

The Canadian labour market broke out of its summer slumber, adding 74,000 jobs in September, nearly all of which were in full-time employment. Total hours worked, which is closely associated with economic growth, rose 0.3 per cent and the national unemployment rate fell 0.2 points to a 6 year low of 6.8 per cent.

The BC economy saw employment grow by 9,600 jobs in September. Moreover, recent losses in full-time work were overturned as full-time employment grew by 20,600 while part-time employment declined by 11,000. The provincial unemployment rate remained unchanged at 6.1 per cent. Year-to-date, employment in BC is up just 0.6 per cent.

For more information, please contact:

Cameron Muir

Chief Economist

Direct: 604.742.2780

Mobile: 778.229.1884

Email: cmuir@bcrea.bc.ca

Brendon Ogmundson

Economist

Direct: 604.742.2796

Mobile: 604.505.6793

Email: bogmundson@bcrea.bc.ca

The British Columbia Real Estate Association (BCREA) is the professional association for more than 18,500 REALTORS® in BC, focusing on provincial issues that impact real estate. Working with the province’s 11 real estate boards, BCREA provides continuing professional education, advocacy, economic research and standard forms to help REALTORS® provide value for their clients.

Real estate boards, real estate associations and REALTORS® may reprint this content, provided that credit is given to BCREA by including the following statement: “Copyright British Columbia Real Estate Association. Reprinted with permission.” BCREA makes no guarantees as to the accuracy or completeness of this information.

Friday, August 22, 2014

What are Buyers Looking For?

What features of your home are buyers most looking for? What should you highlight that will really get potential buyers excited? Check out this video from the Re/MAX Fit To Sell series that helps you identify what it is about your home that buyers want the most. Thinking of selling? We can help! Check out www.gelderman.ca for more info!

Monday, July 28, 2014

6 Decisions to Make Before the Home Search

In the market for a new home but have no idea where to start? There are several decisions you should begin to make before you even start your home search. By asking yourself the right questions, you can quickly pinpoint what you want – and can afford – in your next home.

1. What's your budget? See how your finances stand up to the 28/36 rule, which lenders use to see what you can afford to pay each month. A financial adviser or your real estate agent also can help you crunch the numbers. Going through the mortgage pre-approval process lets you know how much lenders will allow you to borrow – plus it helps you show sellers that you have the funds to backup your offer.

2. What do you need in your new home? How many bedrooms or bathrooms do you need? What about a large kitchen, a home office or a playroom for the kids? How many cars need covered parking? It's critically important to ensure the home you select meets your family and lifestyle needs.

3. Do you want a condo or single-family home? Condos come with much less maintenance. You typically won't be shoveling snow in the winter or replacing the roof, but you'll likely pay monthly association fees to cover services and repairs in the community. Houses, on the other hand, come with more privacy and freedom to customize. They also come with full responsibility for maintenance.

4. How do you feel about living under covenants? Depending on where you buy, you may have to pay homeowner association (HOA) fees in addition to your mortgage. There are benefits to HOAs, such as maintenance, community centers, and maybe even a pool or gym. But you also could be faced with more restrictive rules about the look of the outside of your home, down to the color of your front door, types of window coverings, and whether you can plant flowers in your yard.

5. What school district do you want to be near? Even if you don't have children in the house, local schools will affect your property value. Prospective homebuyers tend to search with education in mind. Do your research on the schools in the areas you'd like to live in.

6. Should the home be move-in ready? Ask yourself how much elbow grease you're willing to put into a home – or how much you'll pay someone else to do the work. Fixer-upper homes can be great after the work is done, but you'll want to figure out your renovation budget before you start your home search. A 203k home-renovation loan might be the right resource for you. If you're not ready for the extra financial commitment of rehabbing a home, or you can't or don't want to wait for remodeling projects to finish up, then a home that's move-in ready might be right for you.

After considering all these factors, you'll be ready to start the home search with a clearer picture of where you're headed. When that time comes, let the Gelderman.ca Team guide you all the way there.

Monday, July 21, 2014

Painting Pointers - Change up your home with colour!

From the RE/MAX blog:

Experimenting with color can be fun, but bold paint choices aren't usually recommended if you're selling your home.

That's when you can turn to the Gelderman.ca Team for guidance. We can advise you on what buyers in your area want and what they don't want. In many cases, the safest color for a home for sale is a neutral shade with the broadest mass appeal.

If you're selling your home, you probably should save the experiments for your new place.

Updating a room? Want to bring some new energy into your home? A brush, a roller and a strategically chosen color can accomplish a lot.

There's no scientific consensus on the psychological effects of different shades of paint, but plenty of interior designers – and Feng Shui practitioners – play by a few basic rules when decorating.

There's no scientific consensus on the psychological effects of different shades of paint, but plenty of interior designers – and Feng Shui practitioners – play by a few basic rules when decorating.

- Green – It's associated with relaxation and growth, and green can be used to create an atmosphere that promotes a calm state of mind. Cool shades of blue achieve a similar effect, especially when combined with design elements related to water.

- Red – Want a call to action? Paint the room red! Symbolizing fire, energy – and some say hunger – red can be effectively toned up or down to achieve specific goals. For example, the darker shade of burgundy expresses richness and sophistication; a bright, apple red is associated with passion.

- Yellow – It's an open invitation. Yellow is considered disarming and joyous when it's bright – and even when it's muted it evokes an energetic response. Use this color in a reading room or office where your mind is stimulated.

- Orange – Increase your creativity and action with orange. In its bright shades, orange can be a great mood-setter for a room where you expect company to gather and fun-loving times.

- White – If you're looking for a light, airy place to promote order and clear thinking, choose white. If it's too stark, consider adding an accent wall of a muted earth tone to warm the room.

- Black – Used well, black can be dramatic. It represents introspection and the mysterious, but for most people, it's a challenging color. Unless you're sure it's what you want (or are willing to repaint if necessary) it's best to stick to black for accent colors, especially in a white room, where it helps create a timeless, grounded feel.

Experimenting with color can be fun, but bold paint choices aren't usually recommended if you're selling your home.

That's when you can turn to the Gelderman.ca Team for guidance. We can advise you on what buyers in your area want and what they don't want. In many cases, the safest color for a home for sale is a neutral shade with the broadest mass appeal.

If you're selling your home, you probably should save the experiments for your new place.

Thursday, July 17, 2014

15 Daily Habits for Success.

I should/could probably write a similar article myself……..so much of success involves seemily small daily habits, that those who shun these often don’t realize the consequences. This is so well written, that I’m simply going to share it:

Fifteen things successful entrepreneurs do every day

From The Globe and Mail:

If you want to become a better entrepreneur and successfully grow your business, dedicate time and energy to improve your daily habits.

1. Eat breakfast. To work at your peak performance, your body needs fuel. Rather than just grab a cup of coffee on your way to the office, take a few minutes to eat a meal or drink a protein smoothie — even if it’s on the go.

2. Plan your day. First thing in the morning, look at your calendar and prioritize your schedule. If you work best during a specific time of the day, block out those hours for quiet work time. I do my best work in the mornings, so I try to schedule at least 90 minutes to work on my writing before daily distractions begin. While you’re at it, schedule short breaks throughout the day to eat a healthy snack and keep your energy up.

3. Don’t check e-mail right away. It’s tough not to hop on your smartphone first thing in the morning and see who’s emailed you. Often checking e-mail is a distraction from what you want to focus on early in the day. Try to wait until 9 a.m. or 10 a.m. to check email, after you’ve completed at least one of your critical to-do items. If you’re working on an important project, try not to check your e-mail more than three times a day.

4. Remember your purpose. Take a few moments at the start of each workday to remind yourself of your company’s goals. Think about your core customer and which areas of your business are most profitable. We oftentimes get caught up in the minutia of daily tasks we lose sight of what brings us happiness and profitability.

5. Single-task. We live in a world that praises multi-tasking. Unfortunately, when you have too much going on at once you may become distracted by interruptions and unimportant glitches. To be productive and effective, prioritize, delegate whenever possible and focus.

6. Visualize. It may feel silly, but close your eyes and envision your success. Imagine what you will feel like when you reach your goals. Visualization is a powerful tool and can help you keep your aspirations at the front of your mind. It might also help to post a picture of what you’d like to accomplish. For example, if you’re interested in taking a trip to Paris, post of photo of the Eiffel Tower on your desk.

7. Say no. Entrepreneurs especially feel pressure to accept every opportunity that comes their way. However, not every opportunity will benefit you or your business. Time is our most valuable commodity. Be selective about what you agree to do.

8. Value your time. Unlike money, time is a non-renewable resource. There’s simply no way to make more of it. Guard your time and spend it doing the most important things for yourself and your company. Avoid distractions whenever possible. Whether you facilitate or attend a meeting, online or in person, get clear about the start and end time. Whenever someone requests a meeting or consultation with you, try asking for the questions in advance so you can do my research ahead of time. This will keeps you on time and on task.

More from Entrepreneur.com

- 5 Tricks to Remembering Anybody's Name

- 5 Morning Rituals to Keep You Productive All Day Long

- Why 'No' is the Most Important Word You'll Ever Say

- For Better Conversations, Replace 'How Are You?' With This One Phrase

- Why You Should Learn to Nap Like a Pro

10. Listen. Be present when you speak with a colleague or employee. Take the time to fully understand what the other person is saying. Leaders who listen effectively avoid miscommunications and are less likely to have to ask for clarification later.

11. Show gratitude. Make it a daily habit to sit down and be thankful for all the opportunities you have been given and all the things you’ve accomplished so far. Simply reminding yourself of your past successes will keep you focused, present and productive.

12. Stand up and move around. Did you know sitting is the new smoking? This car-commuting, desk-bound lifestyle can be harmful to your health. Studies show it raises the risk of disability, diabetes, heart disease, certain types of cancer and obesity. No matter when you can make time for it during the day, take a few minutes to stand up and take activity breaks every hour or so. It’s good for your body and mind.

13. Breathe deeply. Many people take shallow breaths. Every hour or so, stand up from your desk, stretch and take 10 deep breaths. The quick break and boost of oxygen will reinvigorate you for your next task.

14. Take a lunch break. Get up from your desk and eat lunch elsewhere. If you can’t spare even a moment away from work during the day, make lunch your networking hour. Schedule lunch meetings throughout the week with key clients, professional acquaintances or friends.

15. Clear your desk. At the end of each day, clear the clutter from your desk. Put away your pens, stack loose paper and straighten other items. A clear desk will give you a clean slate for the next day and prevent you from feeling bogged down by yesterday’s work.

Copyright © 2014 Entrepreneur Media, Inc. All rights reserved.

Fit To Sell - Furniture Placement

Did you know the right furniture placement and lighting can help make your rooms look bigger and more attractive? Watch this video from RE/MAX fit to sell to get tips and tricks to make your rooms look their best! Thinking of Selling? We can help! We offer complimentary home staging with every sale! Check out www.gelderman.ca for details!

Thursday, July 10, 2014

Great article! Have you had these thoughts about your agent?

3 Signs Your Real Estate Agent Needs a Kick in the Pants

Your partnership with your real estate agent plays a large role in the success of your home sale. To get your home sold quickly and for top dollar, you should follow your agent’s advice about pricing your home and getting (and keeping) it in tip-top shape. You’ll also need to keep your schedule open so your agent can show your home to as many potential buyers as possible.

If you’ve done all your agent has asked of you but you’ve only had a few nibbles while other homes in your area have sold, you might need to step back and figure out why. Take a close look at your agent and their advice, and evaluate their performance in these areas:

Dave recommends agents who have at least five years of experience, but 10 or more years is preferable. You should also look for an agent who closes on a minimum of 40 home transactions per year. When you work with an agent with this kind of experience, you can be confident of two things:

If you’ve done all your agent has asked of you but you’ve only had a few nibbles while other homes in your area have sold, you might need to step back and figure out why. Take a close look at your agent and their advice, and evaluate their performance in these areas:

Your Agent May or May Not Call You Back—It’s a Roll of the Dice

Good real estate agents are busy people, so it’s not always easy to get in touch with them. But a good real estate agent also knows it’s important to keep in contact with their clients, and they make a point of returning calls as soon as possible. If your communication with your agent feels one-sided, that’s a red flag. Even if nothing new has happened, it’s reasonable to expect your agent (or someone from their team) to contact you every week to discuss strategy and whether you need to make any changes to get buyers’ attention.Your Agent’s Marketing Plan Is Based on Positive Thinking

You made the decision to work with an agent because you know you aren’t a real estate marketing whiz. You should be able to depend on your agent to develop an effective marketing strategy that will attract buyers. If the plan isn’t working, your agent should also be willing to step up their game and try new methods to reach buyers. Most importantly, your agent should not blow off your concerns and questions about how much time your home is spending on the market.Your Agent Has More Attitude Than Most Teenagers You Know

That leads us to overall attitude. Do you feel like your agent is super-serving you? Or do you feel like you’re one more box to check off their to-do list? Is your agent showing up late for appointments? Avoiding you altogether (see Roll of the Dice)? Showing a lack of patience with your questions (see Positive Thinking)? Always remember, you don’t have to put up with a bad attitude to work with a great agent who will get your home sold.You Can Do Better

If you’ve decided your current agent isn’t the right one to help you sell your home, you might be hesitant to choose another agent. We have a suggestion that will help you narrow down the field and find an agent who will work for you: Look for experience.Dave recommends agents who have at least five years of experience, but 10 or more years is preferable. You should also look for an agent who closes on a minimum of 40 home transactions per year. When you work with an agent with this kind of experience, you can be confident of two things:

1. Your agent’s got this! They’ll know what to do in tough market conditions because they’ve been through them before. They’ll know how to price your home to attract buyers, and if they don’t hit the bull’s-eye, they’ll be ready with a back-up plan. You can trust them to base their decisions on solid research, and they’ll be willing to discuss all the details with you.

2. You’ll feel like the center of the universe. Word gets around, and real estate agents with a reputation for poor service simply don’t stay in the business long. An agent with several years’ experience has learned to focus on meeting their clients’ goals, and they’ll work hard to make sure you meet your goals as well.

Tuesday, July 8, 2014

Why a Home Doesn't Sell

Wondering why your home won't sell? Or didn't sell in the past? There might be a few reasons why - check out this video from RE/MAX's Fit To Sell Series to find out what you can do to help your home sell. Not on the market yet? Contact the Gelderman.ca Team and we can help!

Monday, June 30, 2014

Canada Day Celebrations!

Looking to do something fun tomorrow for Canada Day? Check out this list of local events!

Chilliwack - Free skating, swimming, kids and family activies, music and fireworks! For more info click here.

Abbotsford - Parade, play zones, community showcase, art, music and fireworks! Click here to learn more!

Mission - tons of family activities including pony rides, dunk tank, firefighter challenge, food, music, Mission's Got Talent and of course - fireworks! See here for more info!

Langley - Canada Day celebrations have been going on all weekend! Tomorrow tops them all with tons of activities, music, a car show, lots of food and....fireworks! Here is the complete info.

Canada Day at Canada Place! So much going on at Canada Place this year - check out all the info on their website!

Website helping out Condo Buyers

From the Toronto Star:

When Paul and Stacey Johnson arrived at the Market Wharf condos recently to tour three units for sale, they knew far more than most licensed realtors about the dollars and sense of the biggest purchase of their lives.

They knew the precise square footage of each suite, instead of just the 800-899 square foot range listed on the MLS. They knew the age of the building, the name of the developer, even which had balconies allowing gas barbecues.

But, most importantly, the Johnsons knew how overpriced each of the two-bedroom units were compared to what’s sold, so far, in the relatively new building just south of St. Lawrence Market.

That’s because Paul spends each morning trolling an innovative and insightful new website called condos.ca — the most comprehensive to date among a new generation of online sites aimed at shaking up the GTA real estate industry and giving buyers, and investors, vital bottom-line information.

“The number one concern for me right now is, am I buying at the peak of the market. I’m not going in with the attitude that I need to make a profit, but I want to know that, in five years, I’m going to at least break even and have had a great place to live in the meantime,” says Johnson.

“I wouldn’t have a lot of that kind of information if it wasn’t for this site.”

Wednesday, June 25, 2014

Buyers Camp out for Three Days for Brentwood Condos

From the Vancouver Sun:

Despite recent predictions about the inevitable burst of the Greater Vancouver real-estate bubble, buyers last week were camped out three days before Saturday’s presale of a new Burnaby mega-project.

“We expected that people would be camped out on Friday — we weren’t expecting them on the Wednesday before,” says Macartney Greenfield, Rennie Marketing System’s project manager.

Brentwood is a 28-acre master-planned community that combines shopping in 350 stores, dining, entertainment and residences in an open-air high street and one-acre public plaza connected to transit.

Of 288 units available in the first tower of the Brentwood development at Lougheed and Willingdon — with occupancy slated for winter 2017 — all were sold on Saturday. Three penthouse units were not yet released, but likely will be in the fall when units for a second 63-storey tower will be made available.

“I think it has a lot to do with the revitalization of Brentwood as a neighbourhood,” says Greenfield. One-bedroom units were offered at $299,000, two-bedrooms at $355,000, and a handful of three-bedroom units were sold starting at $928,000. The condo units start on the 33rd floor, with rental units below.

“The buyers have lived in this neighbourhood,” says Greenfield. “We definitely saw a lot of people buying for their children, and some are just downsizing. There was a lot of local interest.”

Monday, June 16, 2014

New Listing!! 2618 BLACKHAM DR, Abbotsford, BC

2618 Blackham Drive, Abbotsford, BC

Gelderman.ca Real Estate Team

Perfect McMillan Family Home. This 3 bedroom home with a legal 2 bedroom suite is ideally located for a family. Walk to all levels of school, recreation centre(swimming pool, ice rink, fitness centre), parks, public transit and shopping. New stainless steel appliances, blinds, counter tops, cabinet doors, flooring and paint. Nice spacious home and yard, RV parking and located at the end of a cul-de-sac. Don't wait call for your private viewing today. For more photos and full details check out the listing on our website here.

Perfect McMillan Family Home. This 3 bedroom home with a legal 2 bedroom suite is ideally located for a family. Walk to all levels of school, recreation centre(swimming pool, ice rink, fitness centre), parks, public transit and shopping. New stainless steel appliances, blinds, counter tops, cabinet doors, flooring and paint. Nice spacious home and yard, RV parking and located at the end of a cul-de-sac. Don't wait call for your private viewing today. For more photos and full details check out the listing on our website here. Friday, June 13, 2014

Strongest May for Home Sales since 2007

BCREA - Vancouver, BC

The British Columbia Real Estate Association (BCREA) reports that a total of 8,729 residential sales were recorded by the Multiple Listing Service® (MLS®) in May, up 13.9 per cent from May 2013. Total sales dollar volume was $4.9 billion, an increase of 20.6 per cent compared to a year ago. The average MLS® residential price in the province rose to $565,233, up 5.8 per cent from the same month last year.

“Consumer demand was noticeably stronger last month, with unit sales posting their highest level for the month of May since 2007,” said Cameron Muir, BCREA Chief Economist. “Rock bottom mortgage rates are inducing many would-be home buyers to enter the market this spring.”

“With most BC markets now in balanced conditions, home prices are up in nine of 11 board areas,” added Muir.

The British Columbia Real Estate Association (BCREA) reports that a total of 8,729 residential sales were recorded by the Multiple Listing Service® (MLS®) in May, up 13.9 per cent from May 2013. Total sales dollar volume was $4.9 billion, an increase of 20.6 per cent compared to a year ago. The average MLS® residential price in the province rose to $565,233, up 5.8 per cent from the same month last year.

“Consumer demand was noticeably stronger last month, with unit sales posting their highest level for the month of May since 2007,” said Cameron Muir, BCREA Chief Economist. “Rock bottom mortgage rates are inducing many would-be home buyers to enter the market this spring.”

“With most BC markets now in balanced conditions, home prices are up in nine of 11 board areas,” added Muir.

Wednesday, June 11, 2014

BCREA June 2014 Mortgage Rate Forecast

To see the full report click here.

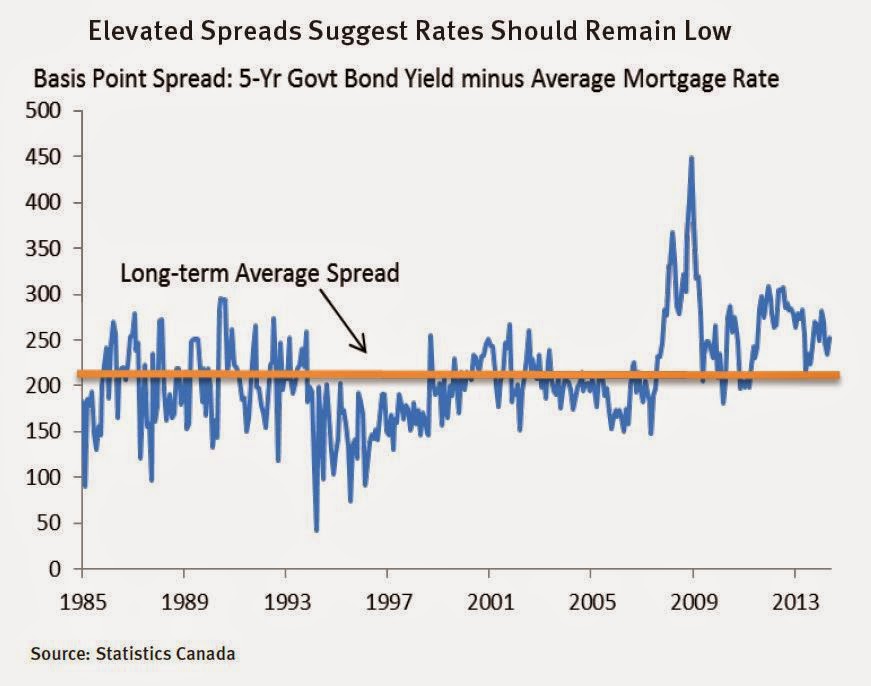

Disappointing first quarter economic growth both in Canada and in the United States, where the economy actually contracted to start the year, are helping to maintain low bond yields in both countries. In particular, yields on five-year Government of Canada bonds, the key benchmark for pricing mortgages, remains approximately 30 to 40 basis points lower than at the start of the year. As the economy improves and the spring home-buying season comes to a close, we expect that mortgage rates will be pulled higher. However, the current spread between the five-year posted rate and the yield on five-year Government of Canada bonds remains elevated. This suggests that a rish in bond yields would exert only modest pressure on mortgage rates.

Mortgage Rate Outlook

Low long-term interest rates and heightened competition in the mortgage market pushed both posted and discounted mortgage rates to record lows during the second quarter. The posted five-year fixed rate reached a historical low of 4.79 per cent in May and many lenders have advertised sub-3 per cent five-year fixed rates as well as steeply discounted variable rates.

Friday, June 6, 2014

CMHC to Stop Insuring Mortgages on Million-Dollar homes, Condo Construction

From the Vancouver Sun -

OTTAWA - Canada Mortgage and Housing Corp. says it will no longer offer mortgage insurance for homes that cost $1 million or more, starting July 31, even if the buyer has made a deposit of 20 per cent or more.

It's a step further than rules introduced two years ago when then finance minister Jim Flaherty announced that CMHC would stop insuring mortgages on homes worth $1 million or more if the buyer borrowed more than 80 per cent of the value.

The Crown corporation says the changes announced Friday would have affected only about three per cent of the mortgage insurance it provided last year for individual homes.

CMHC also announced it will no longer insure loans that are used to finance construction of multi-unit condominium projects, effective immediately.

It says that type of insurance product was introduced in 2010, but CMHC hasn't provided any to builders since 2011.

CMHC also says its mortgage loan insurance for condo buyers isn't affected by the change.

See the news release from CMHC here.

OTTAWA - Canada Mortgage and Housing Corp. says it will no longer offer mortgage insurance for homes that cost $1 million or more, starting July 31, even if the buyer has made a deposit of 20 per cent or more.

It's a step further than rules introduced two years ago when then finance minister Jim Flaherty announced that CMHC would stop insuring mortgages on homes worth $1 million or more if the buyer borrowed more than 80 per cent of the value.

The Crown corporation says the changes announced Friday would have affected only about three per cent of the mortgage insurance it provided last year for individual homes.

CMHC also announced it will no longer insure loans that are used to finance construction of multi-unit condominium projects, effective immediately.

It says that type of insurance product was introduced in 2010, but CMHC hasn't provided any to builders since 2011.

CMHC also says its mortgage loan insurance for condo buyers isn't affected by the change.

See the news release from CMHC here.

Tuesday, June 3, 2014

SOLD!! #156-6299 144th Street Surrey, BC

Gorgeous Townhouse in ALTURA!!

Location, location, location...this spacious end unit townhouse is beautifully finished. Features West Coast Architecture, granite counter tops, stainless steel appliances, open concept kitchen, family room, dining room and living room on the main floor. Master bedroom has a double door entry, vaulted ceilings and a awesome 4piece ensuite. Three bedrooms in total up with 2 full baths. The basement features a rec. room/family room with separate entry to the yard. The complex has a 7800 sqft. clubhouse with pool, hot tub, gym, yoga studio, guest suites, theatre and more. Walk to all levels of school including the Bell Centre. Priced to sell, call for your private viewing today. See full details here!

Monday, June 2, 2014

Royal York and Hotel Vancouver Up for Sale

From the Globe and Mail:

Two of Canada’s most famous hotels – Toronto’s Royal York and the Hotel Vancouver – have been put up for sale by Quebec’s giant pension plan, the Caisse de dépôt et placement du Québec, which is moving out of the lodging business.

The hotels, both managed by Fairmont Hotels and Resorts, date back to the glory days of the railroad and were once among the most impressive in the world. The Royal York opened in 1929 after the Canadian Pacific Railway decided it wanted to build the largest hotel in the British Commonwealth. When it opened, the opulent venue had more than 1,000 rooms and rose up 28 floors, making it the tallest building in the Commonwealth. The Hotel Vancouver opened in 1939 just in time for a visit by King George VI and Queen Elizabeth.

Friday, May 30, 2014

Massive Multi-Million Dollar Family Home being built outside Calgary

From CTV News in Calgary

It looks like a new hotel along a highway but this can’t-miss construction project turning heads just west of Calgary is a huge single-family home.

It’s been under construction for months on Highway 22, just north of the Highway 8 roundabout, and it’s so large that neighbours and people on social media can’t stop talking about it.

According to property records obtained by CTV Calgary, the two-storey home, set on 80 acres, will be 11,000-square-feet when it is complete.

It will also have a nine-car garage, seven fireplaces and two guardhouses that are formidably sized on their own.

The property’s address is 242131 Range Road 42 in Rockyview County, but it’s still so new that you won’t even find it on Google Maps.

The home is being built by Jager Homes and documents list its value at $3,159,594. The cost of permits alone is more than $10,000.

A CTV News crew that went out to the site was asked to leave and was told no information would be given out.

Documents show the home’s owner as “El Condor Lands Inc.,” a division of the Hon Group of Companies owned by Calgary real estate magnet Nicholas Hon. His company Jager home is building the mansion.

A day after our story first ran, Ernest Hon, Director of El Condor contacted our newsroom. “It’s a private home,” he said, “We respect the privacy of whomever will live in there.” He would not disclose if the home was for him, or anyone in his family.

People living in the area and passersby have reacted negatively to the lavish home.

Rhonda Phillips wrote to the Cochrane Eagle, “I don’t think I’ve ever seen a more grotesque and narcissistic tribute to the owner’s ego in my life. Not to mention that it couldn’t be more out of place unless it was built in the middle of some of the slum areas of a third world country.”

Others on chatboards and social media have marveled at its size. A post on the Calgarypuck forum, “Flabbibulin” says it’s, “the biggest bloody house I have ever seen!,” while “OzyFlame” dubbed it, “overly hedonistic,” and “jaydorn” asks, “That's a house?! Drove by there last month and just thought it was a weird place for a hotel/condos. But a single family home?”

While the wooden structure of the building is up, and solar panels are visible on the roof, it appears finishing work is still far from over.

Neighbours tell CTV News that an iron fence has surrounded the property for about two years. Building permits were applied for in July, 2013.

There’s no word on a completion date.

Rockyview County’s last assessment of the land lists it as “vacant farmland” worth $11,500.

The Hons are well-known Calgary developers behind a 42-storey luxury condo tower, the guardian, in Victoria park.

Subscribe to:

Comments (Atom)