To see the full report click here.

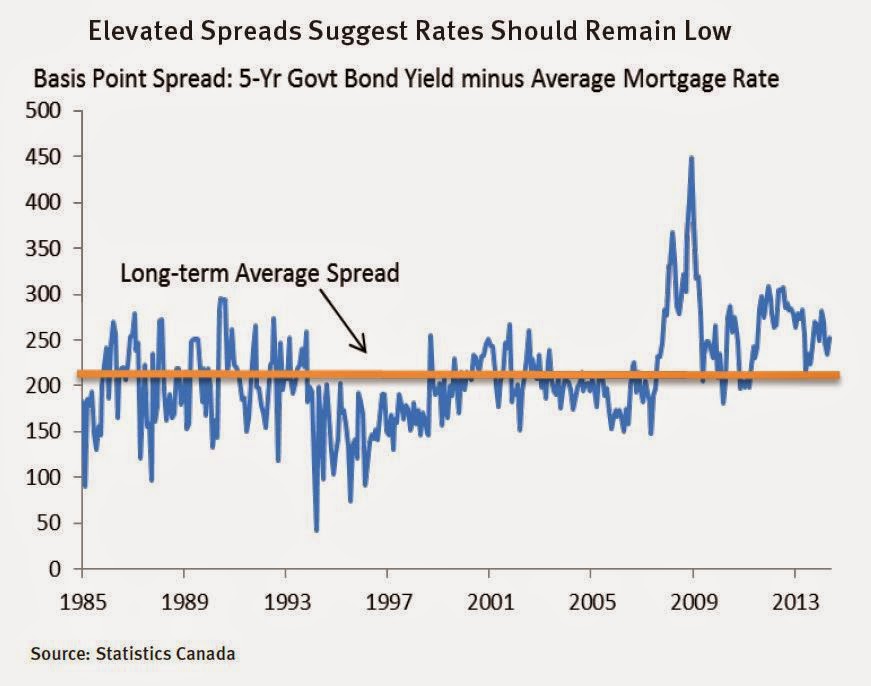

Disappointing first quarter economic growth both in Canada and in the United States, where the economy actually contracted to start the year, are helping to maintain low bond yields in both countries. In particular, yields on five-year Government of Canada bonds, the key benchmark for pricing mortgages, remains approximately 30 to 40 basis points lower than at the start of the year. As the economy improves and the spring home-buying season comes to a close, we expect that mortgage rates will be pulled higher. However, the current spread between the five-year posted rate and the yield on five-year Government of Canada bonds remains elevated. This suggests that a rish in bond yields would exert only modest pressure on mortgage rates.

Mortgage Rate Outlook

Low long-term interest rates and heightened competition in the mortgage market pushed both posted and discounted mortgage rates to record lows during the second quarter. The posted five-year fixed rate reached a historical low of 4.79 per cent in May and many lenders have advertised sub-3 per cent five-year fixed rates as well as steeply discounted variable rates.

Economic Outlook

The Canadian economy sputtered to start 2014, growing just 1.2 per cent in the first quarter. Economic growth was pulled lower by a slowing of household spending and a drag on export growth from weakness in the United States. However, there are good reasons to believe that these trends will prove temporary in nature.

Disappointing growth in the first quarter was due to unusually severe winter weather in both Canada and the United States, which kept consumers at home, and construction projects delayed. Incoming economic data from the US points to a strong second quarter rebound and we expect growth in our largest trading partner to accelerate above 3 per cent for the remainder of the year.

Combined with a low Canadian dollar, stronger growth in the US economy should propel Canadian exports and business investment higher, which would help to offset any further slowing of consumption spending or residential investment. Even with a slow start, we are forecasting that the Canadian economy will expand close to 2.5 per cent in both 2014 and 2015.

Interest Rate Outlook

Inflation in Canada has moved materially higher in recent months, driven by a substantial increase in energy costs. The impact of higher energy prices on headline CPI should fade later this year and the Bank of Canada has already suggested it will look past the transitory increase in inflation.

However, there does seem to be some underlying momentum in core CPI, the Bank’s preferred inflation measure, which if sustained will be much harder for policymakers to ignore. For now, we anticipate the Bank will remain on hold, leaving rates unchanged until 2015.

Once the Bank does move from the sideline, there is a growing consensus that the new normal for interest rates is much lower than it used to be. Although it can fluctuate in the short-run, a "normal" interest rate, in particular the rate set by the Bank of Canada, should be roughly in-line with the rate of potential economic growth in the economy.

The potential rate of growth for Canada has been slowing in recent years due to a number of factors including low productivity growth, the lingering impact of the global financial crisis, and an aging workforce. As growth of the Canadian labour force shows, the rate of growth in goods and services that can be produced in the Canadian economy will almost certainly decline. The implication being that economic growth going forward may be a little slower than in previous eras. Therefore, the appropriate level of interest rates for the Canadian economy may be lower than in the past.

No comments:

Post a Comment