BCREA - Vancouver, BC

The British Columbia Real Estate Association (BCREA) reports that a total of 8,729 residential sales were recorded by the Multiple Listing Service® (MLS®) in May, up 13.9 per cent from May 2013. Total sales dollar volume was $4.9 billion, an increase of 20.6 per cent compared to a year ago. The average MLS® residential price in the province rose to $565,233, up 5.8 per cent from the same month last year.

“Consumer demand was noticeably stronger last month, with unit sales posting their highest level for the month of May since 2007,” said Cameron Muir, BCREA Chief Economist. “Rock bottom mortgage rates are inducing many would-be home buyers to enter the market this spring.”

“With most BC markets now in balanced conditions, home prices are up in nine of 11 board areas,” added Muir.

Friday, June 13, 2014

Wednesday, June 11, 2014

BCREA June 2014 Mortgage Rate Forecast

To see the full report click here.

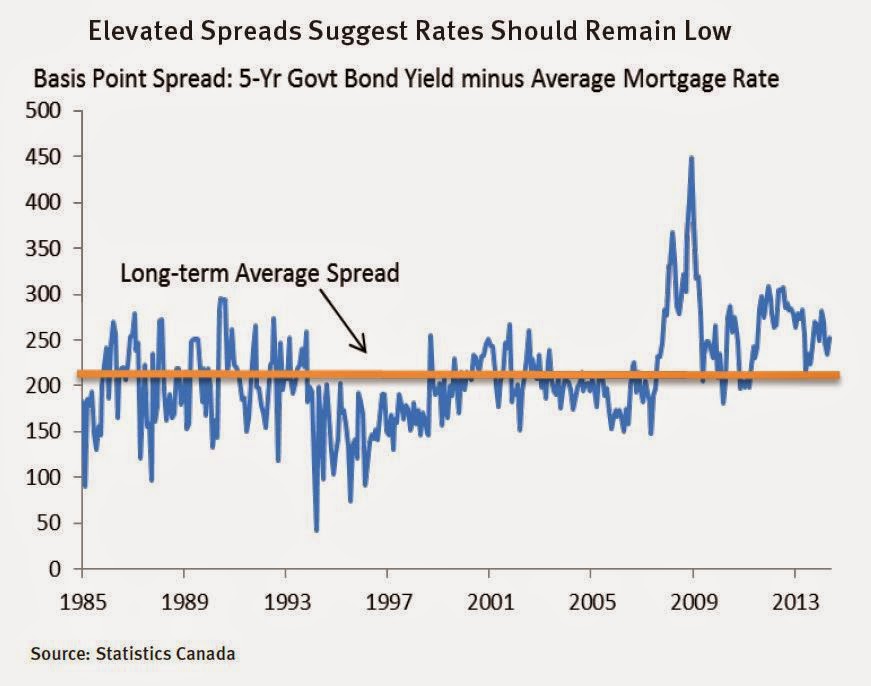

Disappointing first quarter economic growth both in Canada and in the United States, where the economy actually contracted to start the year, are helping to maintain low bond yields in both countries. In particular, yields on five-year Government of Canada bonds, the key benchmark for pricing mortgages, remains approximately 30 to 40 basis points lower than at the start of the year. As the economy improves and the spring home-buying season comes to a close, we expect that mortgage rates will be pulled higher. However, the current spread between the five-year posted rate and the yield on five-year Government of Canada bonds remains elevated. This suggests that a rish in bond yields would exert only modest pressure on mortgage rates.

Mortgage Rate Outlook

Low long-term interest rates and heightened competition in the mortgage market pushed both posted and discounted mortgage rates to record lows during the second quarter. The posted five-year fixed rate reached a historical low of 4.79 per cent in May and many lenders have advertised sub-3 per cent five-year fixed rates as well as steeply discounted variable rates.

Subscribe to:

Comments (Atom)